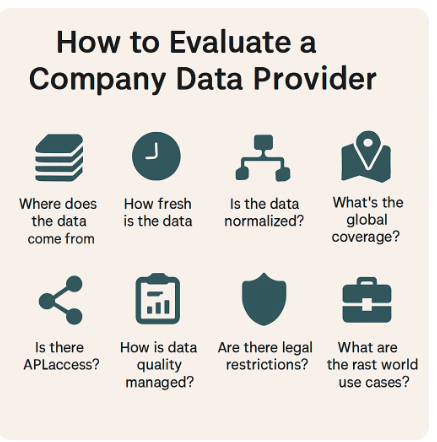

How to Evaluate a Company Data Provider: 8 Questions Product Teams Should Ask

1. Introduction

Choosing the right company data provider is one of the most important infrastructure decisions a product or data team can make.

Whether you’re building a KYB flow, enriching a CRM, scoring leads, automating risk decisions, or powering a public-facing platform — your output is only as good as the data behind it. And most providers don’t make it easy to evaluate what you’re actually getting.

Flashy dashboards and high-level stats might look impressive, but they often hide fundamental issues:

- Is the data sourced from official registries or scraped from websites?

- How fresh is it — days, months, or years old?

- Is the schema normalized across countries, or does everything break outside the US or UK?

Poor choices lead to cascading problems: unreliable segmentation, failed automations, regulatory exposure, and countless hours wasted cleaning or stitching data together.

This guide outlines 8 critical questions every product team should ask before committing to a company data provider — especially if you’re building anything that needs to scale across countries or integrate into your product stack.

Because at the end of the day, it’s not about how many records a vendor has.

It’s about how much you can trust and use them — in production.

2. Where Does the Data Come From?

This is the first and most important question to ask any company data provider — because everything else depends on it.

Many vendors boast about the size of their database but stay vague about where the data actually originates. That’s a red flag.

There are typically three types of sources:

1. Registry-Sourced (First-Party Data)

This is the gold standard. It means the provider connects directly to official government sources — like Companies House (UK), INPI (France), or the Handelsregister (Germany) — and retrieves verified company information at the source.

Pros:

- Legally accurate and up-to-date

- Compliant for KYB, AML, and regulatory workflows

- Trustworthy in legal or contractual contexts

Cons:

- Requires normalization across countries

- Coverage depends on local transparency laws (which vary)

Zephira.ai uses registry-sourced data exclusively across 100+ jurisdictions — no scraping, no guesswork.

2. Scraped or Aggregated Data

This is data scraped from company websites, LinkedIn profiles, press releases, or other third-party sources. It’s often incomplete, outdated, or formatted inconsistently — especially at scale.

Pros:

- Sometimes useful for enrichment (e.g. logos, product pages)

Cons:

- Unverifiable

- High risk of duplication and misinformation

- Often in breach of terms of service or lacking usage rights

If a provider won’t name their sources — or mixes scraped with registry data — be cautious.

3. Partner-Licensed Data

Some vendors license data from third parties like credit bureaus or local resellers. While this can improve coverage, it introduces complexity:

- How often is it refreshed?

- Can you use it commercially or redistribute it?

- Are there legal restrictions based on the original source?

You’ll need to check the fine print.

What to Ask the Provider

- Do you source data directly from government registries?

- Which countries and registries are included?

- Is any of the data scraped or inferred?

- Can I see your data dictionary or registry list?

3. How Fresh and Frequently Updated Is the Data?

Even the most accurate company data becomes a liability if it’s stale.

Outdated financials, inactive companies still marked as trading, or ownership information that hasn’t been refreshed in over a year — these are common symptoms of providers that lack proper sync with registries.

When evaluating a vendor, you need to understand how often their data is updated, and more importantly, what controls that update cycle.

Some vendors operate on a fixed schedule — monthly, quarterly, or even semi-annually — and rely on batch ingestion. This is problematic for any real-time use case like onboarding, KYB, or decision automation, where outdated information can lead to false positives, increased risk, or broken workflows.

Others offer a real-time or near real-time sync directly with official registries. This means that as soon as a new filing, ownership change, or status update appears at the registry level, it’s reflected in their dataset — no delay, no guesswork. That’s the model Zephira is built on.

You should ask the provider:

- How frequently is each registry synced?

- Do they fetch data continuously or on a scheduled basis?

- Is the timestamp of the last registry update included in the record?

- Can you query live records via API, or are you working off static files?

One provider might tell you they have 400 million companies. But if 150 million of them haven’t been updated in the last 12 months, that number means nothing.

Freshness isn’t just a data quality issue — it’s a product risk. If your system relies on knowing whether a company is active today, or what their financials looked like this fiscal year, outdated data breaks trust and functionality.

Always look beyond the size of the dataset. Ask for the last update date — and whether it’s updated on your terms, not theirs.

4. How Is the Data Structured and Normalized?

Global company data is fragmented by design. Each country has its own registry, schema, and standards — and without proper normalization, that fragmentation becomes your problem.

It’s not enough for a provider to “have data” from 100+ countries. What matters is whether that data has been cleaned, mapped, and delivered in a consistent format across:

- Legal forms (Ltd., GmbH, SARL → Private Limited Company)

- Company status (Active, Registered, Trading → standardized lifecycle)

- Industry classification (NAICS, NACE, SIC → unified codes and tags)

- Financial metrics (standardized units, currencies, and fiscal years)

- Entity types (mapped to public, private, nonprofit, branch, etc.)

Without this normalization, your team ends up writing custom logic for every country — creating brittle systems and inconsistent outputs.

A production-grade provider should offer:

- A schema-first model that works across jurisdictions

- Pre-normalized legal forms and statuses you can trust

- Crosswalked industry codes aligned with global standards

- Clear field attribution (registry-sourced vs. enriched vs. estimated)

- A documented data dictionary with definitions and formats for every field

At Zephira, every company record — whether from Estonia, the US, or Brazil — is delivered in a unified structure ready for enrichment, onboarding, or risk scoring without post-processing.

Ask the provider:

- Do you normalize legal form and status globally?

- How do you handle different industry coding systems?

- Can you share your data dictionary?

Because if the structure isn’t consistent, the product won’t be either.

5. What Is the Global Coverage and Depth per Country?

Many data providers advertise impressive global reach — “250 million companies in 200 countries” — but that number often hides a critical issue: uneven depth.

It’s easy to include companies from dozens of jurisdictions. What’s hard is delivering consistent field-level detail across all of them. And for product teams, field depth matters far more than headline record counts.

Ask yourself:

- Can you get financials in Germany, not just a registration number?

- Does coverage in France include shareholder details or just names?

- What about status and incorporation dates in Brazil, or legal forms in Japan?

Too often, coverage means “we have a name and a country” — not the full set of fields needed to power onboarding flows, compliance checks, or CRM enrichment.

When evaluating a provider, dig into:

What to Look For:

- Per-country field availability: Do they offer a detailed matrix by country and field?

- Consistent core attributes: Legal form, status, incorporation date, industry code

- Extended data: Financials, shareholder data, UBOs, ownership hierarchy

- Update frequency per jurisdiction: Is the data refreshed weekly, monthly, or annually?

Here’s how two countries can differ drastically:

| Country | Records | Revenue Available? | Shareholders? | Updated Weekly? |

|---|---|---|---|---|

| UK (Companies House) | ✅ | ✅ | ✅ | ✅ |

| US (State Registries) | ✅ | ❌ | ❌ | ❌ |

This is why Zephira provides field-level transparency, not just country counts. You get a data dictionary that shows exactly which fields are available for each jurisdiction, so you can design your workflows with confidence — not assumptions.

Because for real-world applications, depth beats breadth every time.

6. Can the Data Be Accessed via API in Real Time?

If your product relies on automated workflows — onboarding, enrichment, scoring, or compliance checks — waiting for CSV exports or static files isn’t an option. You need clean, structured company data available on demand, not on a quarterly update cycle.

Real-time access is no longer a luxury. It’s the default expectation for modern platforms.

Here’s what to evaluate:

Key Considerations:

- Is there a REST API? Not just a UI or export tool, but a documented, stable API that lets you retrieve and filter data programmatically.

- Is the data refreshed in real time? Some APIs still deliver stale records behind the scenes — updated monthly or less.

- What’s the average latency? Can the system respond fast enough to integrate directly into live product workflows?

- Is the API structured for developers? Look for clean JSON, consistent field naming, and SDKs or Postman collections.

- Does it support lookups and bulk enrichment? Depending on your use case, you may need both single-record and batch endpoints.

For example, Zephira’s API lets you:

- Query any company by name, domain, or registration number

- Get normalized fields like legal form, industry, revenue, and status

- Enrich CRM records or trigger KYB workflows in real time

- Access historical financials or group structures where available

If your current or prospective provider can’t deliver structured data via API — or their endpoints are slow, incomplete, or poorly documented — that’s a clear limitation.

Real-time data is what powers automation. Anything less puts you a step behind.

7. How Does the Provider Handle Gaps, Inconsistencies, and Missing Fields?

No company data provider has perfect coverage — and anyone who claims otherwise is either overstating or hiding their limitations. What separates good providers from great ones is how they deal with data gaps, inconsistencies, and incomplete records.

Company filings vary widely across jurisdictions. Some registries don’t provide revenue or employee numbers. Others lack shareholder data or financials for smaller entities. Even within the same country, different company types have different disclosure rules.

What matters is how your provider responds to these gaps.

What to look for:

- Do they enrich missing fields? For example, do they estimate revenue and employee count based on other signals (like web traffic, industry, or similar peers)?

- Is it clear which fields are sourced vs. modeled? You should never have to guess whether a value came from an official registry or was inferred.

- Do they flag outdated or unverifiable data? If a company hasn’t filed in years, that should be obvious — not buried.

- How do they handle ambiguity? For example, is “Registered” the same as “Active”? Does “SARL” mean the same as “Ltd”?

At Zephira, every company record clearly shows:

- The source of each field (e.g. registry, enriched, estimated)

- The last update date and filing year

- Whether key fields like revenue, profit, or status were officially filed or modeled

This transparency lets your team build logic around imperfect data — without sacrificing reliability or compliance.

Because gaps are inevitable. But guesswork should never be part of your product.

8. What Are the Legal Rights and Restrictions Around Usage?

Many teams overlook this question — until it’s too late. You integrate a data provider, build it into your product or analytics workflows, and then realize the licensing terms don’t allow for what you’re doing.

Company data often comes with usage restrictions based on how it was sourced. If the provider licenses it from third parties (like credit bureaus or regional aggregators), you may be limited in how you can use, store, or redistribute the data. This is especially critical if you’re enriching a customer-facing product, reselling data, or embedding insights into a SaaS platform.

Some common restrictions to watch for:

- No redistribution or public display

- No use for scoring, risk models, or derivative products

- No resale or sub-licensing

- Field-level restrictions (e.g. financial data can’t be shown in your UI)

Even providers that offer registry-based data may inherit limitations if they source indirectly or through local partners. And vendors that use scraped data often avoid usage questions altogether — because the legal standing is weak.

When evaluating a provider, ask explicitly:

- Can we use this data in a live product or API?

- Are we allowed to store and process it internally?

- Can we display this data to our users?

- Are there limitations by region, field, or use case?

Zephira is different. Because we source data directly from public registries and enrich it ourselves, we offer clear and flexible rights — including support for embedding, enrichment, internal analytics, and productized use cases.

You shouldn’t have to worry about hidden clauses or legal gray zones.

If you’re building with data, you need to know exactly what you can do with it.

9. What Real-World Use Cases Does the Provider Support?

A provider may offer broad data coverage and strong claims — but the real test is whether their data has powered production-grade use cases for companies like yours.

Can their platform handle the technical, legal, and operational demands of live workflows in B2B SaaS, fintech, compliance, or sales automation? Or are they just a data aggregator with a shiny UI and no battle-tested track record?

Ask for concrete examples. Don’t settle for vague customer logos or generic use cases.

Look for:

- KYB & AML onboarding: Does their data support regulatory-grade checks across countries, including registry verification, company status, and ownership details?

- CRM enrichment & sales intelligence: Can they deliver normalized fields like revenue, employee count, and industry tags that plug into HubSpot, Salesforce, or custom CRM systems?

- Credit risk scoring: Are financials, legal forms, shareholder funds, and company age reliable and complete enough to drive credit decisions?

- Lead routing & ICP filtering: Can their industry, size, and location data be used to automate go-to-market logic at scale?

- Entity resolution & deduplication: Is the data consistent enough to power identity resolution across markets?

At Zephira, our customers use our company data to:

- Build real-time onboarding flows for KYB across 150+ countries

- Automate enrichment for tens of thousands of CRM records

- Enhance compliance screening tools with verified legal and financial fields

- Support product-led growth by delivering accurate firmographics via API

If a provider can’t show how their data holds up in production — across multiple verticals and use cases — it’s a sign that their infrastructure isn’t built for serious teams.

10. Final Thoughts

Choosing a company data provider isn’t just a sourcing decision — it’s a product decision. The data you integrate into your platform becomes part of your customer experience, your compliance posture, and your operational efficiency. If it’s unreliable, out of date, or poorly structured, the impact ripples across every system you build.

What matters most isn’t how many records a vendor claims to have — but whether those records are trustworthy, normalized, up-to-date, and accessible in the way your team actually needs them.

To recap, here are the eight questions every product or data team should ask before committing:

- Where does the data come from?

- How fresh and frequently updated is it?

- Is the data structured and normalized across countries?

- What’s the actual field-level coverage by country?

- Is there a real-time API built for developers?

- How are gaps and inconsistencies handled?

- What rights do we have to use and display this data?

- Has it been proven in real-world use cases similar to ours?

At Zephira, we’ve built our platform around those questions.

- Registry-sourced, globally normalized

- Delivered via real-time API

- Structured for scale

- Transparent on rights

- Built for developers

Because company data isn’t just data — it’s infrastructure.

And if you’re building serious products, you need data you can build on.

Frequently Asked Questions (FAQ)

1. What should I look for in a company data provider?

Look for transparent sourcing (ideally from government registries), up-to-date information, normalized global schema, real-time API access, and clearly defined usage rights. Bonus points if the provider supports your exact use case, like KYB, enrichment, or credit scoring.

2. Why does data normalization matter for company records?

Without normalization, legal forms, statuses, industry codes, and financials vary wildly across countries. This leads to integration issues, incorrect logic, and broken workflows. A unified schema ensures consistency across borders and platforms.

3. What’s the difference between registry-sourced and scraped data?

Registry-sourced data is verified, legal, and accurate — pulled directly from official government databases. Scraped data is collected from websites or third-party sources and is often outdated, inconsistent, or non-compliant with commercial use.

4. How can I tell if company data is fresh and reliable?

Check the last update date, filing timestamps, and how frequently the provider syncs with each registry. Real-time or near real-time updates are critical for compliance and automation.

5. Can I use company data in my own product or SaaS platform?

Only if your licensing agreement allows it. Many providers have strict restrictions on redistribution, scoring, or resale. Always verify usage rights before integrating company data into a commercial product.

6. Does Zephira support global KYB and enrichment use cases?

Yes. Zephira offers normalized, registry-sourced company data across 150+ countries, including fields like registration status, legal form, industry, revenue, and ownership — all accessible via real-time API for use in onboarding, compliance, and product enrichment.